Overview

Smart Money Invest began as a B2C application in 2015 to directly compete with the very first Robo-Advisor Platforms in Canada and was one of the first five to be given this permission.

Challenges - B2C

Challenge #1

Custodial Fees

Most competitors either managed substantial AUM before building their products or were created by already very large companies. Some of these companies were big enough to acquire banks and registered custodians. This allows for them to charge extremely competitive rates, in some cases, even 0. To compete on this level, this product will have to offer value elsewhere to make up for the difference in cost.

Challenge #2

Operation Size and Funding

The size of competitor teams enables them to move very quickly on larger builds which allows them to push to market at a fast pace. To compete with this as a smaller team, only the most important features and most important “value-added” features can be focused on for launch.

Challenge #3

Lack of Acceptance

The Robo-Advisor concept was still very new in 2016 and entirely revolves around the idea of making people think differently about a way of managing money that is centuries old and that has changed very little. The proof of concept would have to be based on the success of the individual advisors, as opposed to the broader new technology.

Challenge #4

Already Committed

Because money management has existed for so long and has traditionally been offered through either banks, large institutions, or smaller firms operating though one of the former, convincing people to change their way of doing business would be very difficult.

Changing Course

After a short period of time, a strategic partnership changed the focus of the company and forced it to reform into a full-service B2B, and B2B2C platform which still maintains B2C capabilities to directly service clients that want to join.

Challenge #1

Antiquated Technology - Decades of information stored in one place

Most existing traditional firms and portfolio managers already have years worth of client accounts and management tied to old systems. Information here is entered into manually and often haphazardly when they submit their paperwork. This makes for an extremely difficult time convincing them to migrate their clients away from their current custodian.

Opportunities

Opportunity #1

Focusing on integrating information from any custodians

Building a generalized system with basic information requirements that could be expected from any custodial database. This would allow for partnerships to be formed with anyone without them having to migrate any clients at all and could visualize their existing data on the platform seamlessly.

Opportunity #2

Introducing group savings plans

Building in a B2B2C offering would be an additional access point that would not require a major build to accommodate. This model would make the partner company do a lot of the lifting for client engagement (their employees) and also present an opportunity for other independent accounts to be opened by those same clients who are already registered.

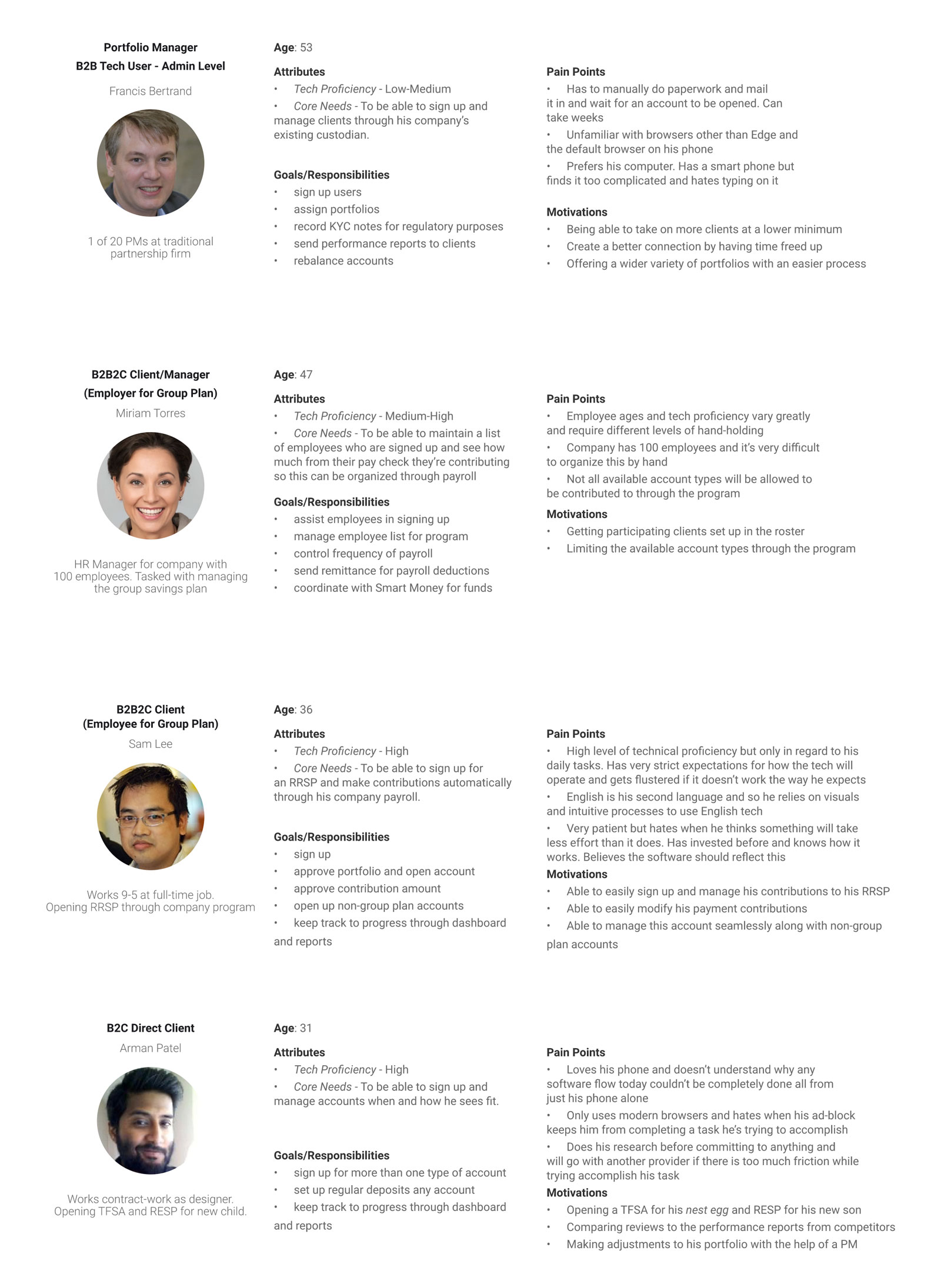

Empathy

Using data gained from interviews during the signups, as well as feedback given directly from our partnerships who all conducted private testing, I was able to come up with 4 key user profiles. I use this data to better empathize with our main user groups and try to improve the product by taking their cirumstances into consideration.